All Categories

Featured

Table of Contents

[/image][=video]

[/video]

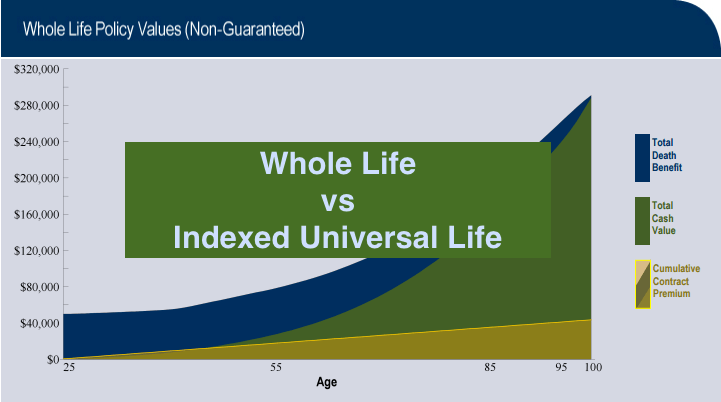

The policy obtains worth according to a fixed schedule, and there are fewer fees than an IUL plan. Nonetheless, they do not featured the flexibility of readjusting costs. comes with much more versatility than IUL insurance coverage, indicating that it is likewise extra complex. A variable plan's cash money value may rely on the efficiency of particular supplies or various other securities, and your costs can additionally transform.

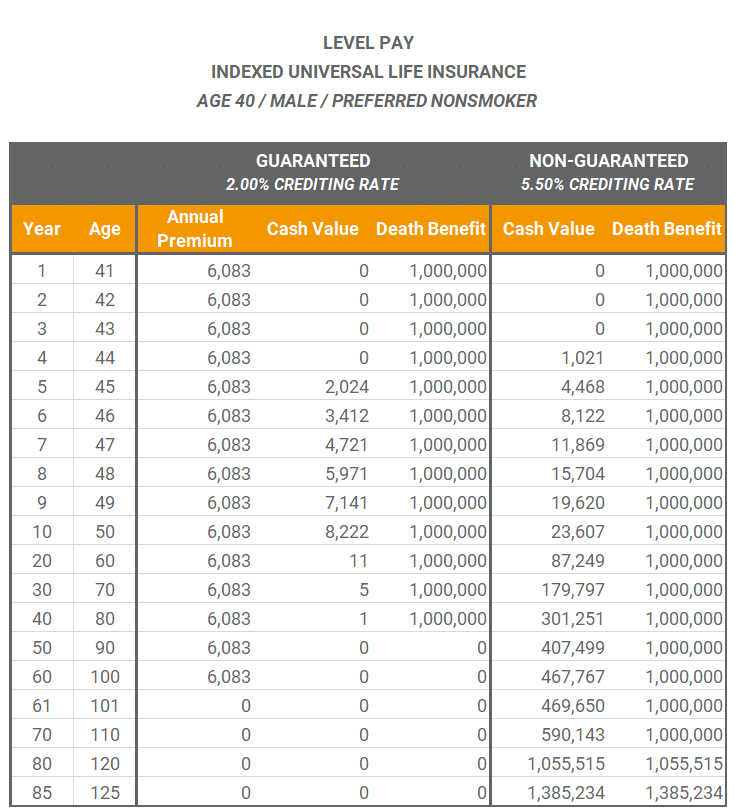

An indexed global life insurance coverage plan includes a survivor benefit, along with an element that is connected to a supply market index. The money worth development depends upon the performance of that index. These plans supply higher prospective returns than other forms of life insurance policy, as well as higher dangers and additional costs.

A 401(k) has more investment choices to pick from and might come with an employer match. On the other hand, an IUL features a death benefit and an added money value that the policyholder can borrow versus. They also come with high premiums and charges, and unlike a 401(k), they can be canceled if the insured quits paying right into them.

These plans can be extra complicated contrasted to other kinds of life insurance policy, and they aren't always best for every capitalist. Speaking to a seasoned life insurance agent or broker can help you make a decision if indexed universal life insurance policy is an excellent suitable for you. Investopedia does not give tax, financial investment, or monetary services and recommendations.

Tax Free Retirement Iul

IUL policy motorcyclists and customization choices permit you to tailor the policy by boosting the death advantage, adding living advantages, or accessing money value earlier. Indexed Universal Life Insurance Policy (IUL Insurance) is a long-term life insurance policy policy offering both a survivor benefit and a cash money worth element. What sets it aside from other life insurance policy plans is how it deals with the financial investment side of the cash money worth.

It is essential to note that your cash is not directly bought the supply market. You can take money from your IUL anytime, however charges and surrender charges may be connected with doing so. If you need to access the funds in your IUL policy, evaluating the advantages and disadvantages of a withdrawal or a car loan is important.

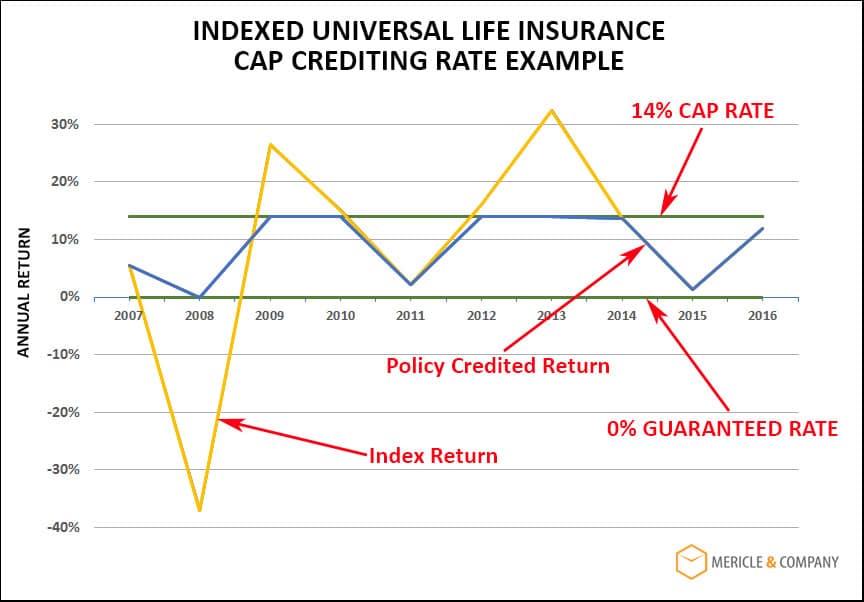

Unlike straight investments in the securities market, your cash value is not directly purchased the hidden index. Rather, the insurance provider uses economic instruments like options to link your money value growth to the index's performance. One of the unique attributes of IUL is the cap and flooring rates.

Equity Indexed Universal Life Insurance

The death advantage can be a set quantity or can consist of the cash money value, depending on the policy's structure. The money worth in an IUL policy grows on a tax-deferred basis.

Constantly evaluate the plan's information and consult with an insurance policy specialist to completely understand the benefits, constraints, and expenses. An Indexed Universal Life Insurance plan (IUL) supplies a special blend of functions that can make it an appealing alternative for specific individuals. Below are several of the crucial benefits:: Among the most enticing elements of IUL is the capacity for greater returns contrasted to various other kinds of long-term life insurance policy.

Taking out or taking a car loan from your policy might reduce its money worth, survivor benefit, and have tax obligation implications.: For those interested in legacy planning, IUL can be structured to supply a tax-efficient method to pass wide range to the future generation. The survivor benefit can cover inheritance tax, and the cash money value can be an added inheritance.

While Indexed Universal Life Insurance Policy (IUL) offers a series of advantages, it's important to think about the prospective downsides to make an informed choice. Right here are a few of the key disadvantages: IUL policies are a lot more complicated than traditional term life insurance policy policies or whole life insurance coverage policies. Recognizing exactly how the cash value is linked to a securities market index and the effects of cap and floor prices can be challenging for the average consumer.

Universal Index Life Insurance Pros And Cons

The costs cover not only the cost of the insurance coverage however additionally administrative costs and the investment component, making it a more expensive alternative. While the cash worth has the possibility for growth based on a supply market index, that growth is typically topped. If the index executes exceptionally well in a given year, your gains will be limited to the cap price specified in your policy.

: Adding optional features or cyclists can increase the cost.: Exactly how the plan is structured, including how the cash money worth is designated, can also influence the cost.: Different insurance provider have various rates models, so looking around is wise.: These are costs for handling the plan and are normally subtracted from the money worth.

: The prices can be comparable, yet IUL supplies a floor to assist safeguard versus market downturns, which variable life insurance policy policies usually do not. It isn't easy to provide a precise price without a particular quote, as rates can differ considerably in between insurance suppliers and individual circumstances. It's crucial to balance the relevance of life insurance coverage and the demand for included protection it gives with potentially greater costs.

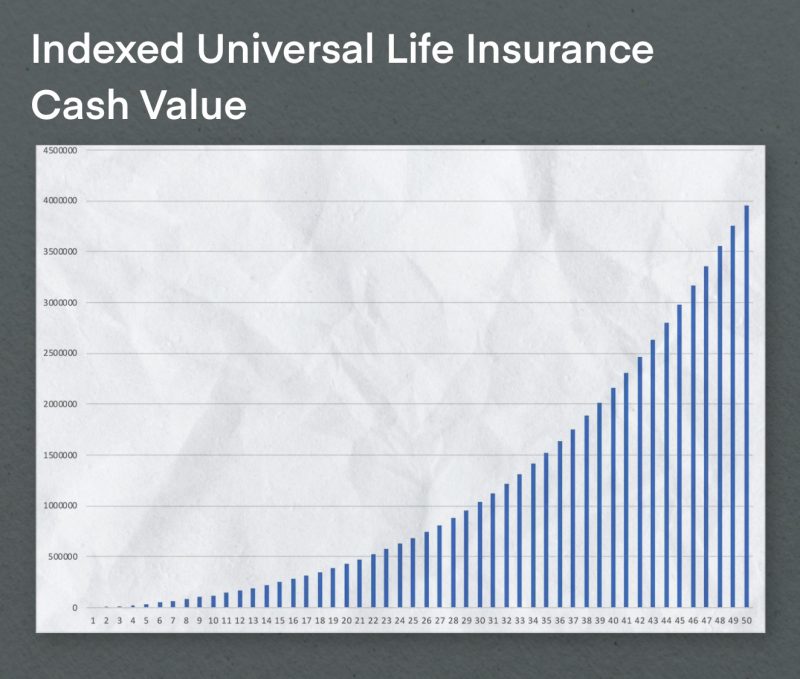

They can help you recognize the expenses and whether an IUL plan aligns with your monetary objectives and requirements. Whether Indexed Universal Life Insurance Policy (IUL) is "worth it" is subjective and depends on your economic goals, threat tolerance, and lasting planning demands. Right here are some factors to consider:: If you're seeking a long-term investment lorry that gives a fatality advantage, IUL can be an excellent alternative.

Secure your enjoyed ones and save for retired life at the very same time with Indexed Universal Life Insurance Coverage.

Equity Indexed Universal Life Insurance Policy

Indexed Universal Life (IUL) insurance coverage is a kind of irreversible life insurance policy policy that combines the features of conventional universal life insurance policy with the capacity for cash money value growth connected to the efficiency of a stock market index, such as the S&P 500. Like various other types of long-term life insurance policy, IUL supplies a death benefit that pays to the recipients when the insured dies.

Cash value build-up: A section of the costs settlements enters into a cash value account, which gains rate of interest over time. This money worth can be accessed or borrowed versus during the policyholder's life time. Indexing choice: IUL policies provide the opportunity for cash money worth development based upon the performance of a securities market index.

Just like all life insurance policy items, there is also a set of risks that insurance holders need to recognize before considering this kind of policy: Market danger: Among the primary dangers related to IUL is market risk. Since the cash worth growth is connected to the efficiency of a stock exchange index, if the index chokes up, the cash money worth may not expand as expected.

Index Universal Life Insurance Dave Ramsey

Sufficient liquidity: Insurance policy holders need to have a stable financial scenario and be comfy with the exceptional repayment needs of the IUL policy. IUL enables for versatile costs payments within specific limitations, yet it's necessary to preserve the policy to guarantee it achieves its desired purposes. Passion in life insurance protection: Individuals that require life insurance policy protection and a rate of interest in cash worth growth might locate IUL appealing.

Prospects for IUL should have the ability to understand the auto mechanics of the policy. IUL may not be the best choice for individuals with a high resistance for market threat, those that focus on affordable financial investments, or those with even more instant financial demands. Consulting with a qualified monetary consultant that can supply personalized advice is essential prior to taking into consideration an IUL plan.

All registrants will obtain a calendar invitation and web link to sign up with the webinar via Zoom. Can not make it live? Register anyhow and we'll send you a recording of the presentation the next day.

Nationwide Indexed Universal Life

Policyholders can lose cash in these products. Policy loans and withdrawals may create a negative tax lead to the event of gap or policy surrender, and will certainly decrease both the abandonment value and death benefit. Withdrawals may be subject to tax within the first fifteen years of the agreement. Customers ought to consult their tax advisor when taking into consideration taking a plan funding.

Minnesota Life Insurance Coverage Company and Securian Life Insurance policy Business are subsidiaries of Securian Financial Group, Inc.

Please refer to the policy contract for the specific terms and problems, particular details and exclusions. The plan stated in this page are safeguarded under the Policy Proprietors' Security System which is carried out by the Singapore Down Payment Insurance Policy Corporation (SDIC).

For additional information on the types of advantages that are covered under the plan as well as the limitations of protection, where appropriate, please contact us or check out the Life Insurance coverage Association, Singapore or SDIC web sites () or (www.sdic.org.sg). This promotion has not been assessed by the Monetary Authority of Singapore.

Table of Contents

Latest Posts

Tax Free Retirement Iul

Indexed Universal Life Contract

Fidelity Iul

More

Latest Posts

Tax Free Retirement Iul

Indexed Universal Life Contract

Fidelity Iul